Shifting Gears with Activity-based costing

Recently, I took stock of my weekends. As a lifelong Cleveland Brown’s fan, my Sunday’s can best be described as “tumultuous”. I’m also an outdoors enthusiast who loves hiking, biking, and climbing. The choice here should be obvious: get outside, get some exercise, and explore. Yet somehow, 95% of my autumn Sunday’s inevitably conclude with a $65 bar tab and a Brown’s meltdown. Much like a personal inventory, an Activity-Based Costing study can highlight toxic operating procedures, SKUs, and even customers, giving companies a chance to shift gears and enhance profitability.

DPO&Co drives often unthinkable impact for clients through Activity-Based Costing (ABC) studies. During these engagements, we dive deeply into all activities required to get product out the doors, or to service a given customer. Often, we find companies (especially middle-market companies) struggle to properly allocate overhead and can neglect the opportunity costs across their portfolios. One recent client faced both problems and was struggling with profitability. The client had 10+ production lines and faced capacity constraints, which led to a backlog of unfilled orders. To exacerbate things, the products they manufactured were facing quality challenges that had to be put “on hold”. Understandably, the client’s approach was to prioritize the orders from their most important customers. Which begs the question: who is your most important customer? When challenged with this question, a common response is the “largest customer”. However, when faced with a backlog and barring contractual responsibilities, firms ought to lean on profitability / EBITDA accretion as the key factor in prioritization.

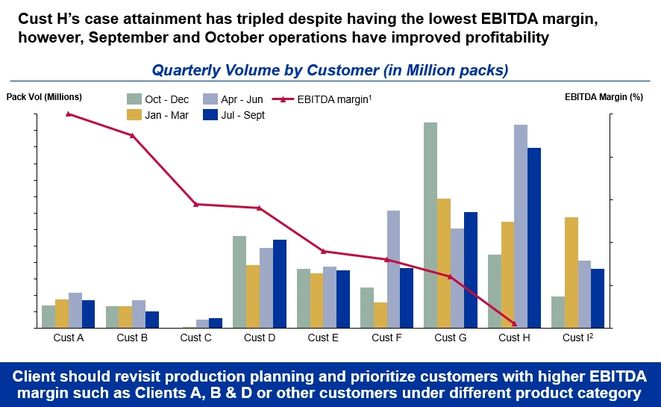

With our guiding principles in place, we set out to determine profitability at the customer and SKU level. The client had been prioritizing its largest customer by volume, contributing ~30% of the plant’s total volume. However, after incorporating setup and changeover times, asset intensity, intercompany transfers and additional activities dictated by customer behaviors, we discovered this “key customer” was actually EBITDA destroying (see figure 1 below). While the largest customer’s volume helped absorb some fixed costs, any volume would have done that given the backlog. The client was better off selling to similar customers that would pay a higher unit price. Given these more profitable alternative options, we recommended shifting prioritization towards the higher-performing SKUs, while increasing price on this portfolio dilutive customer.

Figure 1. Customer Volume and Profitability

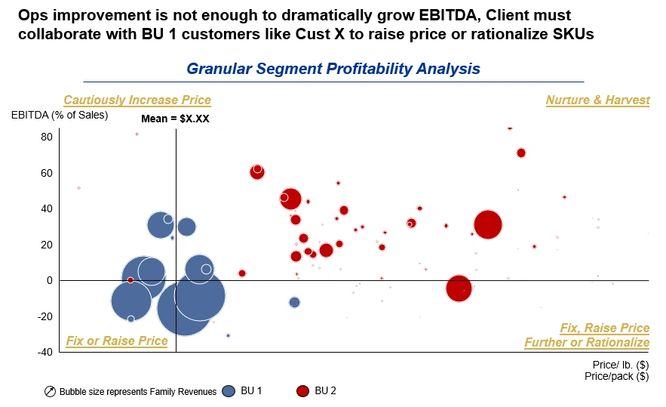

In addition to analyzing activities across customers and SKUs, we also honed in on profitability across the client’s facility. The facility was segmented into 2 business units, with ~80% of the client’s revenue coming from BU1. Naturally, the client had allocated a significant portion of its investment and strategic focus to BU1. However, BU2 was significantly more profitable, driving >100% of the company’s EBITDA through ~20% of total revenue, with GM about 20% higher than BU1 (see figure 2). Until undertaking the ABC project, the client’s PE owner had no idea they owned such a “diamond in the rough”.

Figure 2. Profitability by BU

While an ABC study seems best designed for manufacturing companies, DPO&Co has executed similar projects for distribution companies, mobile service companies and more.

In the same way that planning a 15-mile hike can keep you on track to achieve personal goals, scheduling the most profitable customers, services, SKUs, and product lines can ensure adherence to business objectives. An Activity-Based Costing exercise is a great way to enable a holistic view into true profitability across the portfolio and make better business decisions. Contact DPO&Co today and let’s unpack this together.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.