Solving for the free-loader problem

Lessons on Enhancing Profitability and Strengthening Relationships with Multi-Site Customers

We’ve all been out to dinner with “that guy”. A large group, an expensive restaurant, an inevitable check-split, and that one guy who seems to be ordering a few too many solo dishes. Do you really need the French onion soup to accompany your 8 sides and that tomahawk ribeye? Much like the problem subsidizing your opportunistic dinner companion, many service companies face a similar challenge fulfilling jobs with their multi-site, national and regional customers.

DPO&Co works extensively with PE backed, mid-market services firms and recently completed a profitability study with a client facing precisely this issue. The client’s end customers operate in the quick-service restaurant industry, with a diverse customer base, national footprint, limited competition, and relatively low price elasticity. However, despite revenues exceeding $25M, EBITDA was near break even. They maintained ~20 service centers across the US and we quickly recognized a strong correlation between distance from service center and profitability; quite simply, the less windshield time, the better the margin. As we dug deeper, we found that 17% of their jobs actually had a negative gross margin. As Milton Friedman quipped: “don’t worry about that; we’ll make it up on volume”. Our analysis indicated that by simply culling these negative GM jobs, this client could realize $950K in EBITDA. On the surface, it appeared “firing” those customers would be a quick win of nearly $1M. Like a George Costanza relationship gone awry, “it’s not you, it’s me”. It immediately became apparent that this tactic would be a gross oversimplification. The core challenge emerged: key customers prefer a one-stop shop at the corporate level and tend to lean on uniform pricing.

The issue of suboptimal customer locations diluting gross margins across a key customer banner has been a consistent problem for many of our clients. Similarly, we often see the reflex mechanism to stifle discussions on providing location-level pricing. The clients tell us the risk of losing multi-million dollar customers is too great. While certainly acknowledging the sensitivity of this scenario, we believe this challenge is difficult, but not insurmountable. In fact, if managed systematically, we’ve found tactics that can both enhance profitability, while strengthening customer relationships. After all, in what other area do customers prefer boiler plate options over customized, collaborative solutions? Here are a few methods we have employed to solve for the ‘free-loader’ problem:

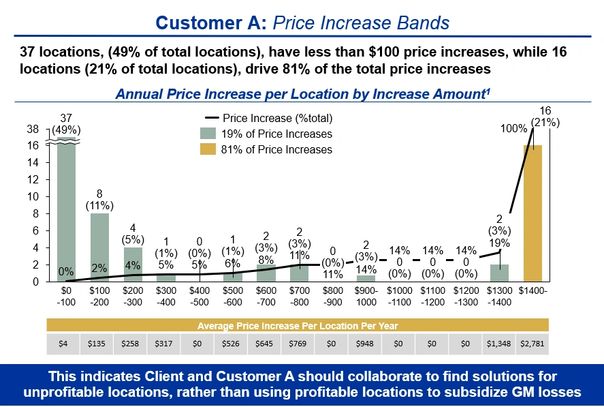

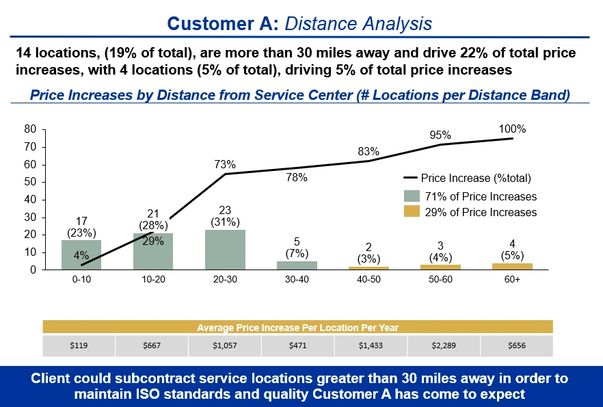

1. Segment the Data to Conduct Fact-Based Discussions: your customer may not be aware of the gross disparity in cost to service the full range of their sites. Your initial reaction might be “they don’t know and they don’t care”, but they might care if a collaborative approach could unlock better service. Consider building a profitability pareto similar to figure 1 below. From this chart, you can see that 16 locations (21% of total locations for this customer) are driving the bulk of the problem (81% of proposed price increases). Segment this data by any relevant parameters; in our case, we also examined profit versus driving distance (figure 2) due to the correlation mentioned above. We found that anything >40 miles is simply too far to drive and these sites should be investigated first if we are to drive improvement for all parties across the total value chain.

Figure 1. Customer Pareto by Location

Figure 2. Specified Customer Pareto

2. Identify Subcontractors to Absorb Low Margin Jobs: after identifying the problematic jobs and relevant criteria (e.g. distance in our study), the first option should be to consider subcontracting these jobs. Our client was able to capture 25% of the job revenue through a subcontractor and alleviated all unnecessary travel time and cost. Your key customer maintains its one-stop shop and you improve GM. Two watch-outs are quality and administrative cost. It’s critical to identify optimal subcontractors, who will maintain your firm’s quality standards and don’t require significant administrative oversight. Challenging, but possible. Just like short-cuts, if it was easy, it would just be the way!

3. Review Tiered Pricing with your Customer: after exhausting the subcontracting option, if problematic sites still exist, prepare materials for a key customer discussion. If your customer remains vigilant in maintaining a simplified pricing scheme, consider tiered pricing. Again, you can utilize the relevant criteria (see figure 3) to create the segments and reduce the subsidizing issues, although not eliminating it completely.

Figure 3. Segment Based Pricing

4. Upsell Additional Services: upon completion of the preceding steps, if low margin sites still exist, consider upselling additional services. Our client had the capabilities to perform these value-add services and the fact-based key customer discussions are an ideal forum to reiterate these options. Selling these services can assist in raising the blended rate up to sufficient levels, while maximizing the value of each technician’s trip.

Discussing the bill is never an easy conversation, whether it’s dinner with some friends or a key customer’s annual review. But utilizing a few key tools and a systematic approach can lead to a smoother customer conversation, enhancing profitability and strengthening relationships across the value-chain.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.