Operations Focused Value at Stake (VAS)

The Quarterback gets the glory, the Offensive Line gets a Rolex. In football, success is often attributed to the high-profile positions, but the Line is the foundation for winning. Similarly, in the world of M&A, financial value creation steals the show, but if the underlying operations are flawed, the paper synergies quickly fly off the paper. As a result, more and more PE firms are relying on Ops-Focused Due Diligence to supplement their traditional financial diligence.

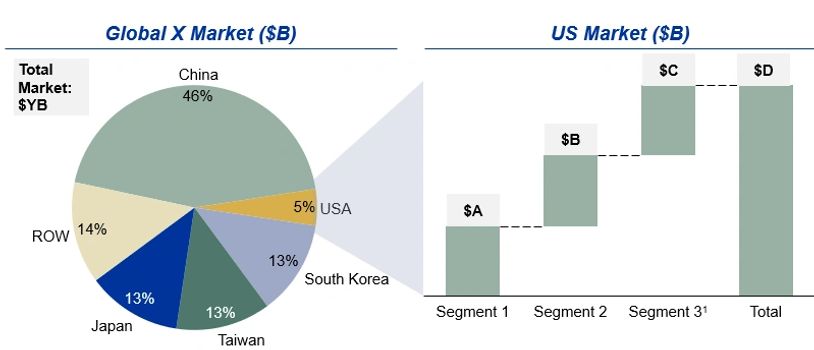

DPO&Co has developed a systematic process to conduct Ops-Focused DD to calculate the true Value-at-Stake (VaS) of the proposed deal. First, we can help our clients find an investment sweet spot, still flying under the radar, but with a strong value proposition. In a recent diligence, we found an attractive market in US manufacturing that many would expect to off-shore to China (figure 1); however, due to IP sensitivity and the necessity for quick prototype turns, this sufficiently large, US-based market appears to have stabilized and, is ripe for consolidation.

Figure 1. Example of Market Analysis

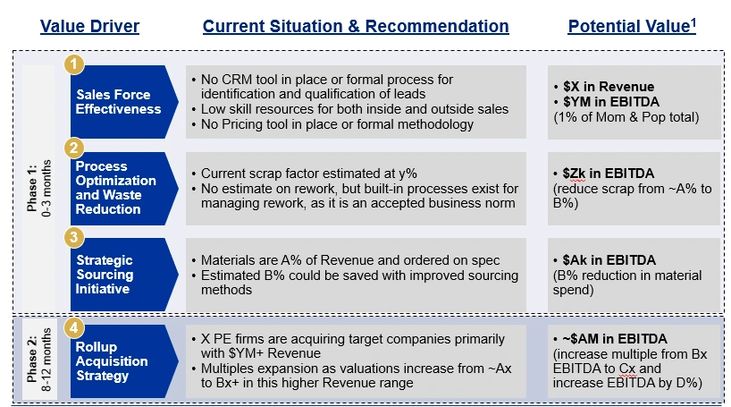

After the deal is on the table, DPO&Co can integrate the diligence process, the same way a financial team would assess Quality of Earnings (QoE); we’ll assess operational VaS. To do this, we assess the target’s customers, assets, product lines, and internal team. In the industry previously mentioned, we found a target with a high-quality facility, solid asset base of modern equipment, consistent history of profitable growth, and motivated seller seeking retirement. We quickly assessed the firm’s capabilities and quality of operations, leading to a two-phase value creation plan, with a clear total VaS (figure 2).

Figure 2. Value Creation Plan

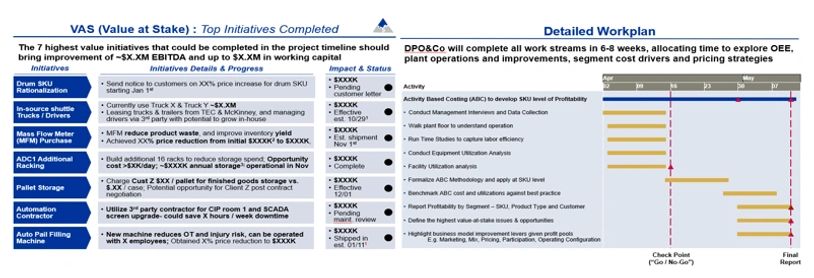

Upon creating the high-level plan, we develop a comprehensive list of initiatives and build more detailed workplans. This operational road map enables the acquiring firm to hit the ground running after close and immediately begin adding value. This immediate value creation also de-risks the overall investment by raising the target company’s EBITDA to Debt Service ratio.

Figure 3. VAS List and Tactical Action Plan

As the private equity space continues to crowd with new capital, deals are becoming more competitive and LPs are demanding more value creation from GPs. Ensuring the quality of operations in are in place is an ideal way to drive this plan, properly evaluate opportunities to make bids more competitive and de-risk investments. Contact DPO&Co to help you put a Value-Stake in the groundand achieve your investment goals.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.